FreshBooks Review: Online Accounting for Small Business

FreshBooks has become known as the web-based accounting choice for freelancers, sole proprietorships, and small startups. Its popularity has also attracted a rapidly growing base of small-medium enterprises (SMEs). FreshBooks is the best choice for sole proprietors, freelancers, and small businesses with <$1 million in annual revenue. FreshBooks boasts an incredibly intuitive interface and its intelligent host of features that easily meets the needs of the smallest businesses.

Here’s a summary of the different plans FreshBook offers:

| FreshBooks Pricing Overview | ||

| Plan | Number of Billable Customers | Price |

| Lite | 5 | USD 7.50/month |

| Plus | 50 | USD 12.50/month |

| Premium | 500 | USD 25.00/month |

| Select | >500 | Custom Pricing |

FreshBook’s software is clearly priced to move. You enjoy a 10% discount if you sign up for an annual subscription, and you can enjoy a 30-day free trial at any tier, too. FreshBooks costs more than free accounting alternatives like Wave, buts its sheer ease of use and rich-functions make it worthwhile for business owners.

FreshBooks’ UI: Intuitive and Simple

Setting up FreshBooks is easy. It’s a quick 3-step process: you enter details about your business, select your invoice style (logo, background colour, fonts), and then you’ll send a test invoice to make sure everything’s working.

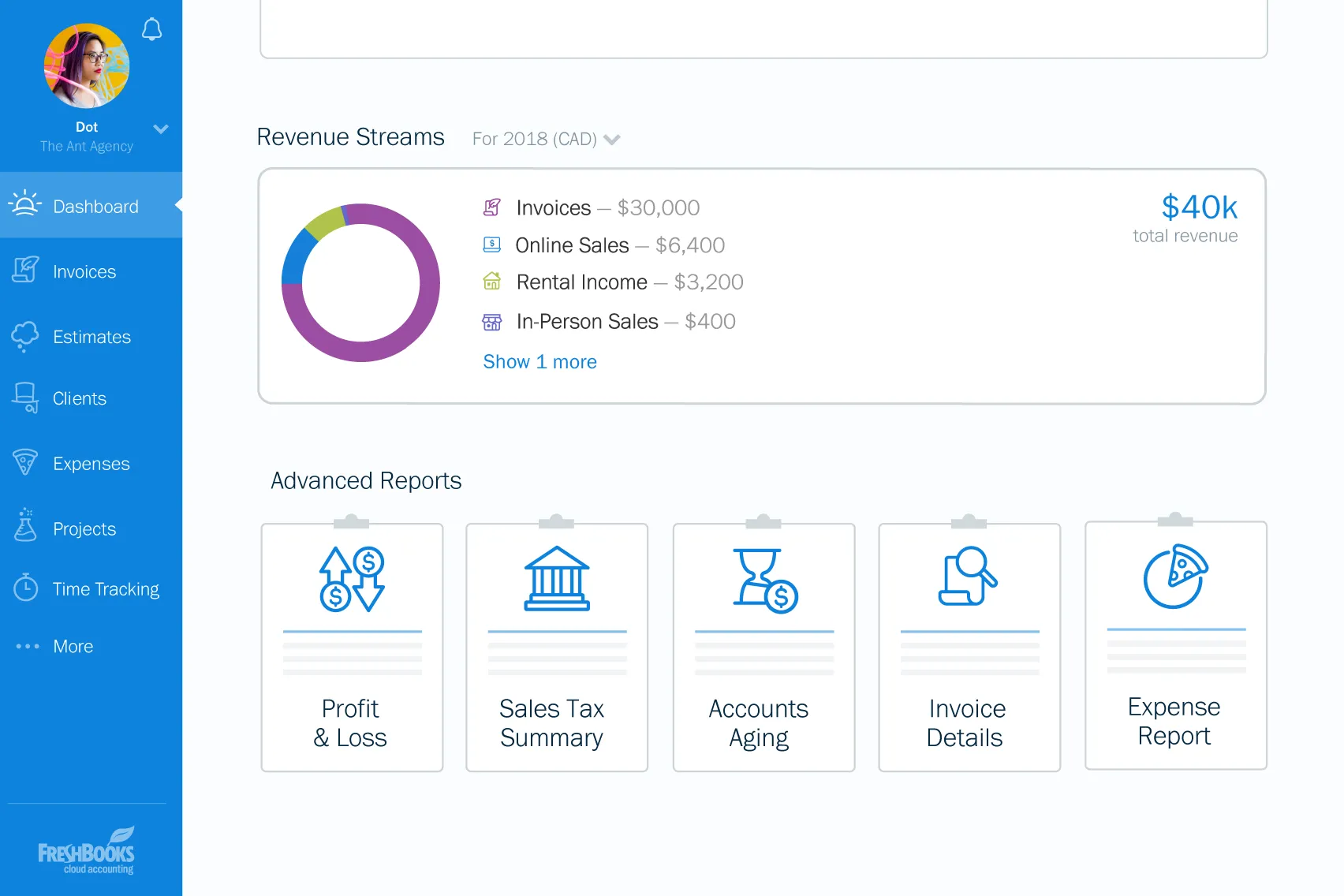

After set-up, you’ll see your Dashboard. This gives you an overview of your company’s finances. In Dashboard, you’ll see 5 items:

- Outstanding Revenue: Which customers owe you payments

- Total Profit: Real-time P&L

- Spending: Total expenses, with breakdown by type of expenditure

- Revenue Streams: Total revenue, with breakdown by type of revenue

- Unbilled Time: Useful if you need to rebill a client or if you categorised a time entry incorrectly

FreshBooks user interface features training videos so you can make full use of the platform, and access to customer support so you can quickly troubleshoot issues. The UI allows you to easily invite team members (like an accountant) so you can collaborate on projects together. You can set various permission levels so you don’t have to worry about unwanted changes being made by people who shouldn’t be making changes.

FreshBooks also has excellent importing functionality. You can provide your username and password for financial institutions like banks. You can then import all your transaction records from those accounts automatically. One of the most common pros that FreshBooks users cite is its sheer ease of use. All the different functions are clearly labelled, you don’t have to go through multiple menus to find what you need, and you certainly don’t need to be an accountant to understand hwo to use the sfotware. All these are great points for people running a business on the side, or small businesses owners who don’t have complex accounting needs and want to save time on accounting.

Compared to other tools like QuickBooks or Xero, FreshBooks has the the most simple and easy-to-use UI.

FreshBooks Features

Double-Entry Accounting

In 2019, FreshBooks added bank reconciliation and double-entry accounting (https://www.freshbooks.com/press/releases/freshbooks-adds-bank-reconciliation-and-double-entry-accounting-to-its-small-business-friendly-software). The lack of double-entry accounting was something that previously had kept businesses that weren’t micro enterprises away from FreshBooks. With this recent and much-welcomed addition, FreshBooks now supports industry-standard accounting practices.

Adding double-entry accounting capabilities provides business owners with well-structured accounting records, and helps improve visibility into the financial performance of the company.

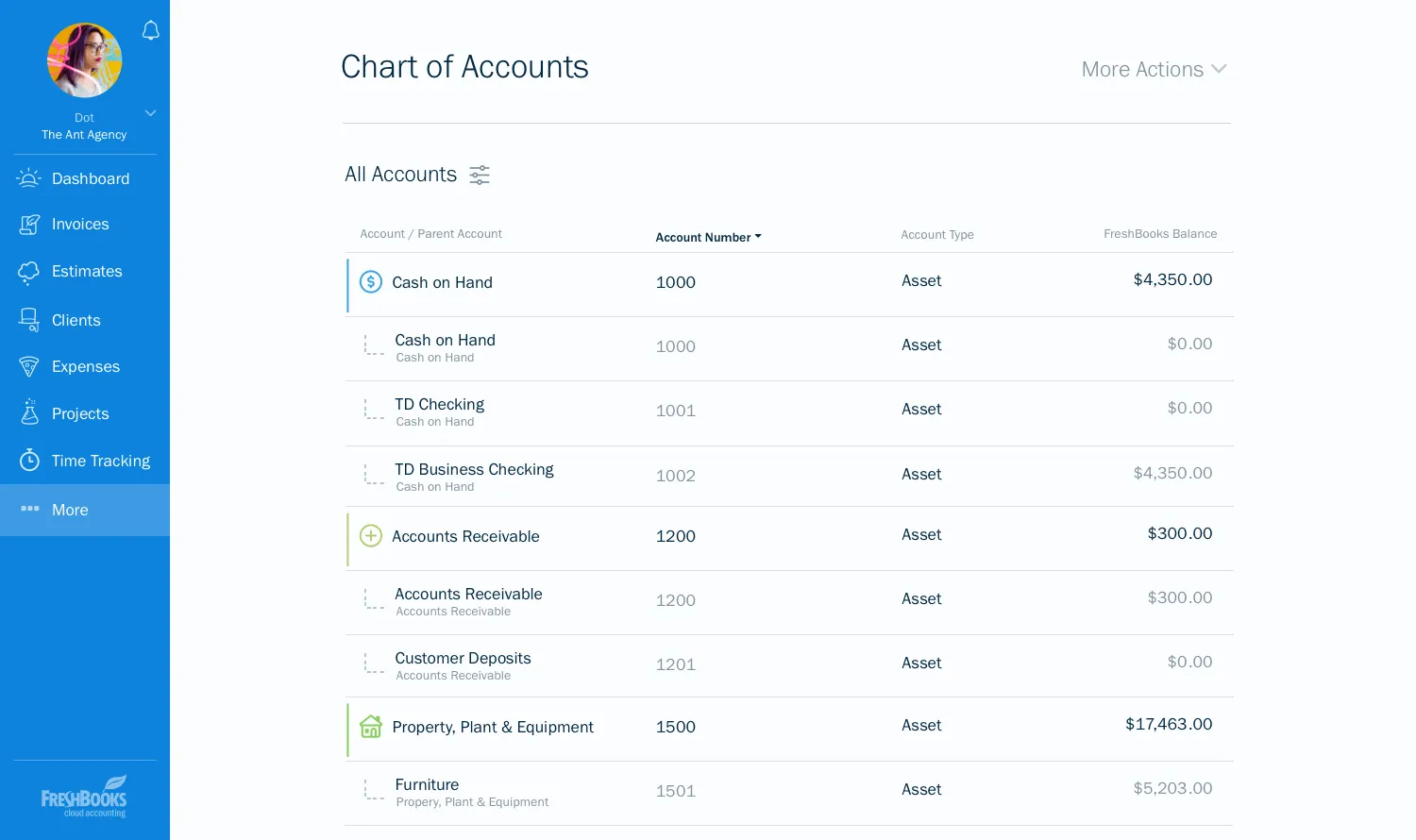

Chart of Accounts

The Chart of Accounts provides a quick overview of all the company’s major accounts:

- Assets

- Liabilities

- Equity

- Revenue

- Expenses

See all important assets, liabilities, and more in one look

Being able to view the status of all these major accounts in one quick glance helps business owners stay constantly updated on the financial health of the company.

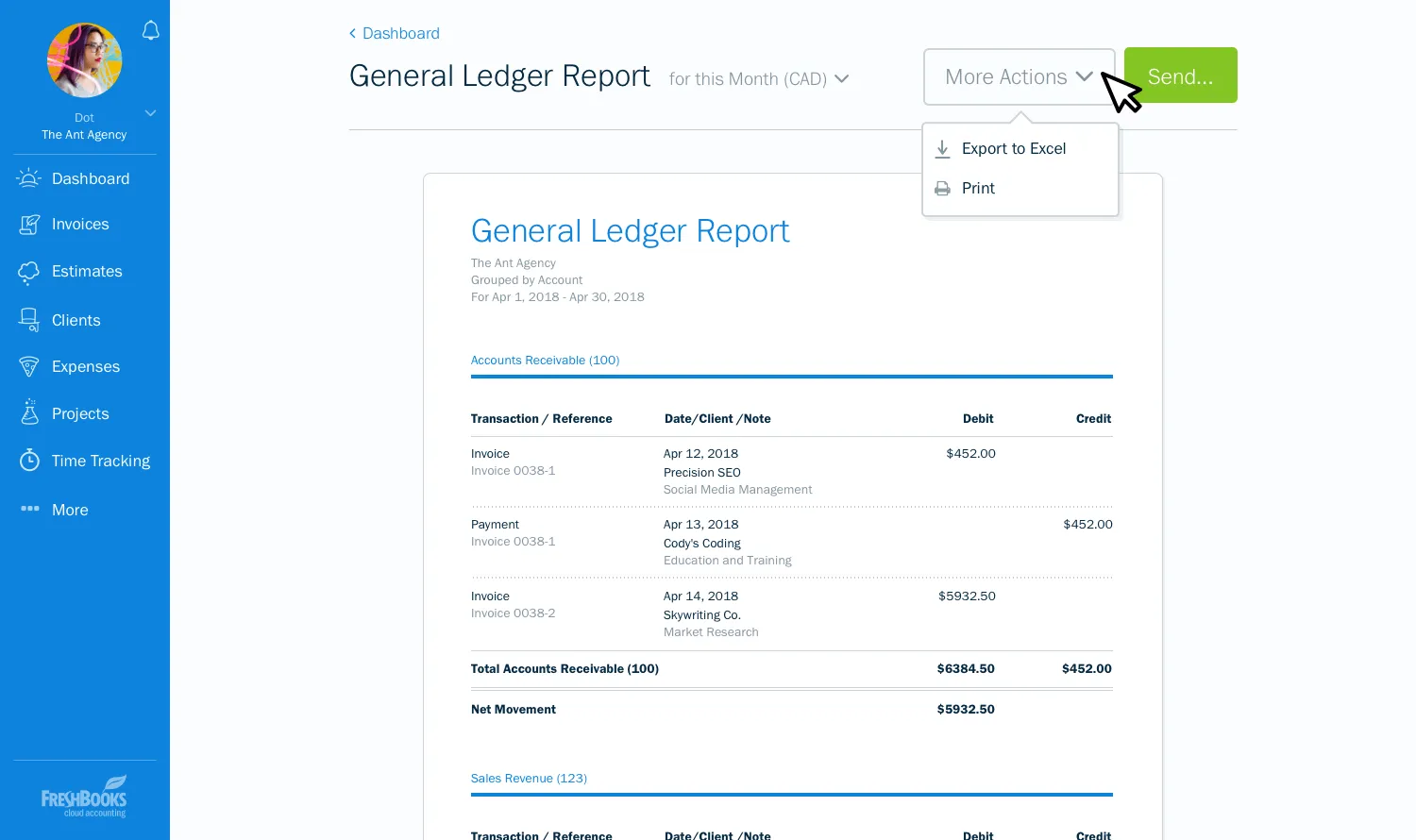

General Ledger

This is a complete record of all your financial transactions so that you can prepare your financial statements. With it, you can thoroughly understand how each account has performed, and where they stand currently.

These accounts include:

- Assets

- Liabilities

- Revenues

- Expenses

- Gains and Losses

Trial Balances

As part of its double-entry accounting update, FreshBooks allows you to create trial balances to ensure that all your accounts are properly balanced. You can use this to easily check if all your debits and credits are properly matched.

Creating Invoices

FreshBooks allows you to easily create professional-looking invoices easily. The software has templates with designs customised for multiple industries like construction, web design, attorneys, and more. (URL) You can see invoice amounts that are overdue, unpaid, and currently being drafted. see dollar totals for invoices that are overdue, outstanding, and in the draft stage. Templates are also available in Word, Excel, PDF, Google Docs, and Google Sheets.

FreshBooks’ invoice function has additional features that are unique to it: the ability to request a deposit, and setup a payment schedule.

Besides invoices, FreshBooks features two more types of transactions: estimates and proposals. Both of these can be converted into invoices, which is very helpful.

Estimates: Send estimated prices to your clients easily. You can duplicate estimates and view their statuses (sent, viewed, accepted, declined).

Proposals: This is one of FreshBooks’ coolest features that distinguish it from other competitors. You can create detailed client proposals that are many pages long, complete with text, graphics, images, and attachments. Proposals come with default sections that help you clearly outline what you’re offering: Scope of Work, Timeline, Pricing, Notes, and Terms. FreshBooks supports electronic signatures, so your clients can sign your proposals. There aren’t any other accounting platforms on the market that offer such detailed transaction features.

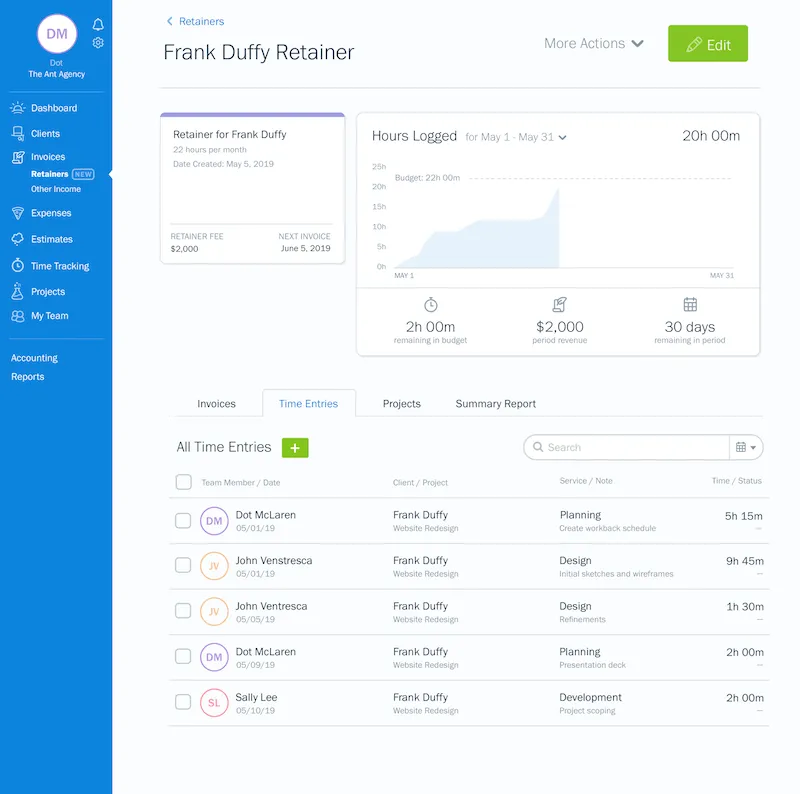

Retainers

Another useful feature is the ability to create retainers. With this function, you and your clients can set up budgets and work-hours to be performed. All the hours that you log via the “time-tracker” tool is automatically debited from the client’s available time balance, and invoices are even automatically generated which makes billing very easy. If you log more hours than the client has agreed to pay you for, those extra hours are automatically categorised as excess work-hours, which you can then send the client an invoice for.

This is helpful for handling continuous businesses transactions with clients, and takes the repetition out of creating invoice after invoice to the same customer.

Payments and Sales Taxes

FreshBooks allows you to accept payments from your customers. For US and Canada customers, this is powered by either WePay or Stripe, and for international customers, payments are processed by Stripe. If your business is in Singapore, domestic transaction fees are 3.4% + SGD 0.50 for every payment. International transaction fees are an additional 1%.

FreshBooks allows users to add sales taxes directly to your invoices. So if you need to add GST charges to any invoices, you don’t need to go hunting around in another panel. Unfortunately, handling sales taxes aren’t the most convenient with FreshBooks, because you do have to add sales taxes manually to each invoice that you create. FreshBooks can save the sales taxes you key in (e.g. 7% GST, 20% VAT, etc.), but you’ll still need to select them each time you want to apply the tax.

Add taxes to any invoice line item directly

Specify in detail what kind of tax you’re paying

FreshBooks has a Sales Tax Summary function that will generate sales tax reports. Business owners will find this helpful to consolidate all necessary information to file their annual tax forms.

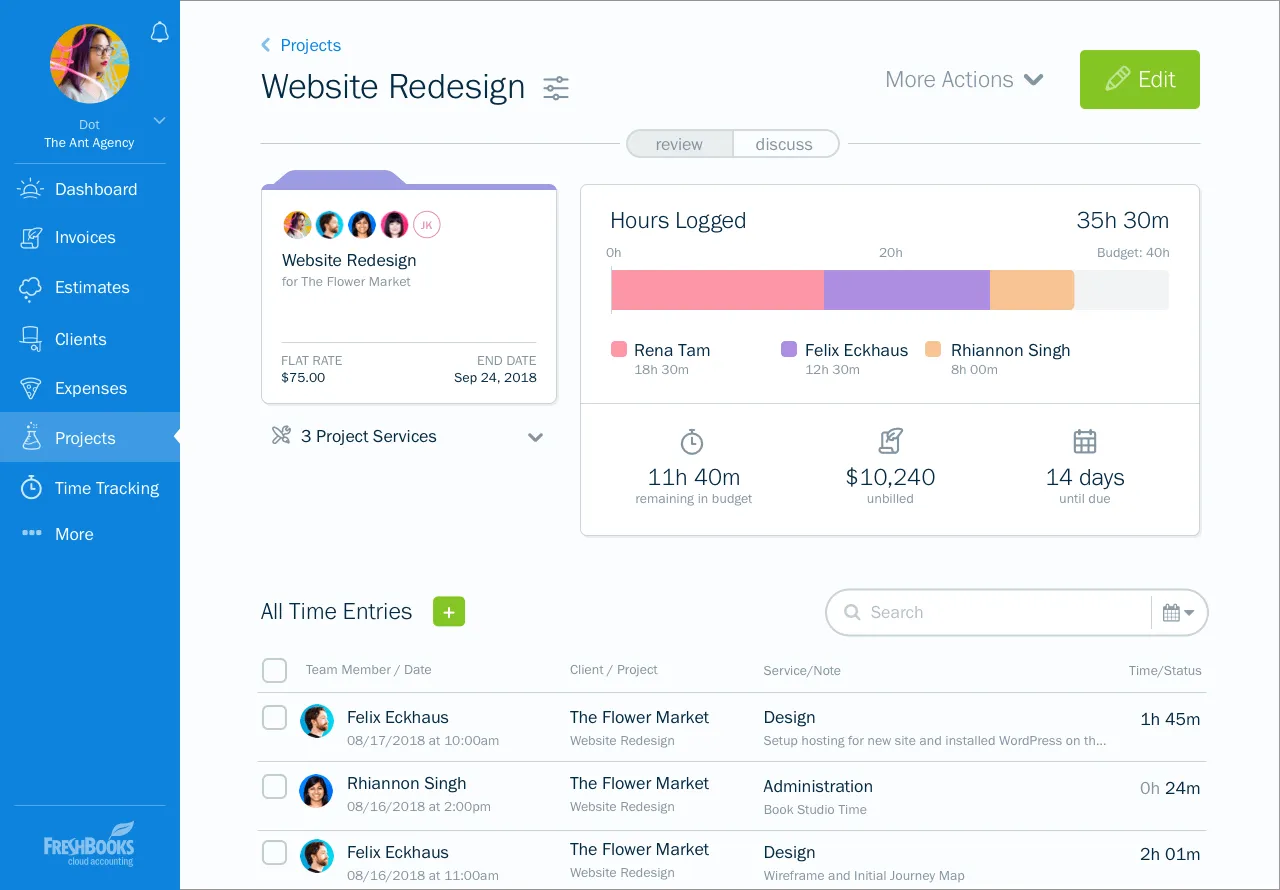

Project Tracking

FreshBooks allows you to create projects, which are a useful way to collaborate with clients, employees, and external contractors in a single place. Project management features here tend to be more extensive than its competitors.

There are a variety of useful functions that projects feature:

- Assign employees, clients, and contractors (you can set individual access restrictions for each member)

- Specify budgets for projects

- Set project type:

- Hourly rate project (allows you to set a single hourly rate, or rates by team member/service provided)

- Fixed rate project

FreshBooks’ hourly rate function is particularly useful as it allows you to customise rates by employee. So if you run a construction company, and you charge clients different rates for say, your engineers vs architects, you can make this clear in your projects. This not only helps you track your own revenues, but also provides transparency and accountability to your clients, which reduces the chances of billing disputes.

When managing a project, you can specify the services that will be provided to your client. You can create a service type (e.g. graphic design, consulting, etc.), save it, and then reuse it for all future projects which eliminates the need for you to enter the same thing repeatedly. This also helps clients understand exactly what services were provided.

When you’re tracking time in a project, you can either enter the amount of time manually, or use FreshBooks’ timer function. The Time Tracker tool will show you all the hours worked by each contributor, giving you a clear view of how much each person has worked. You can convert a project or time entries to an invoice.

Time Tracking

FreshBooks allows you track the time spent on tasks by your team members. Time tracking can be done automatically (start/stop buttons), or can be keyed in manually. This helps you easily bill for every hour that your team and you have worked. You can view at a glance how much time each employee is spending on particular tasks, what work has been done (or not yet done), so you can intervene if certain tasks or employees are falling behind.

Contacts, Expenses, and Payables

Contact Management: FreshBooks’ clients function contains all your clients’ information: it displays their contact information (in a nice graphic of a business cards). It shows you how much outstanding revenue is linked to the client, with a breakdown of this revenue into unbilled time, unbilled expenses, and invoices. You can send invoice statements directly to your clients from this panel, and can also set automatic late payment notices and invoice reminders to be sent to them.

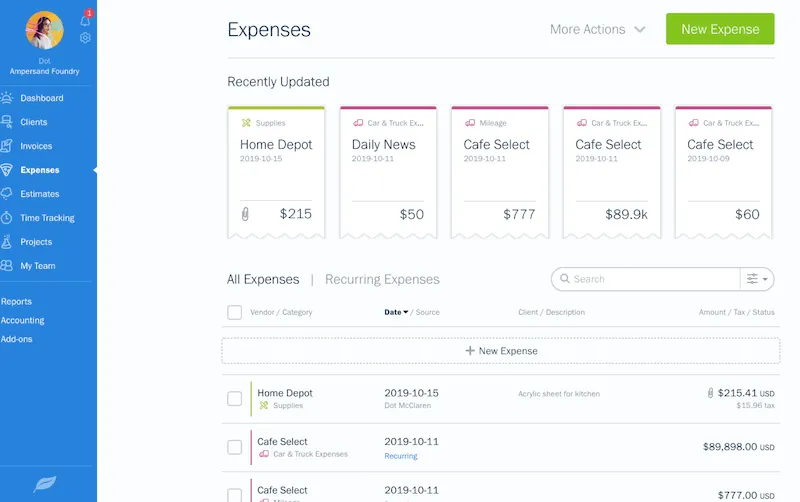

Expense Tracking: If you connect your bank accounts to FreshBooks, you can view recent transactions you’ve made on the “Expenses” panel. FreshBooks will automatically categorise these transactions (e.g. Office Supplies, Transport, Advertising, etc.) when it imports them from your bank account (it doesn’t always get them right). Do note that these bank connections are not “live” feeds and are only updated once a day.

If you’re entering expenses manually, you can upload receipt images (accountants sing hallelujah), specify vendor names and expense descriptions, and allocate the expense to a category (e.g. advertising, rent, etc.). FreshBooks comes with a list of 45 default expense categories, which are set up to closely mirror IRS tax categories. US users will find this the most useful, but Singaporean users will benefit from this too . In any case, you can create your own expense categories to supplement the comprehensive default list. You can also designate expenses as Cost of Goods Sold (COGS) to easily track your margins. FreshBooks easily has one of the most comprehensive expense-management functionalities compared to other providers at a similar price point.

Accounts Payable

FreshBooks doesn’t have an Accounts Payable (AP) function that allows you to key in bills that you owe. It does, however, allow you to view bills that other FreshBooks users send you. This is one area that the software falls short. If you need to manage high volumes of payables, then you should probably consider using either QuickBooks or Xero.

Currency Support

FreshBooks supports 170 currencies and 14 international languages. If you do business across multiple countries, you won’t have a problem using FreshBooks.

FreshBooks’ Mobile Apps

FreshBooks’ mobile apps are available on both Android and iOS, and are very well designed. The apps are just as easy to use and have the same features as the web-based version. In both cases, the FreshBooks app opens to a dashboard that contains three critical charts, Outstanding Revenue, Total Profit, and Total Spending. Icons at the bottom of the screen take you to the working areas of the tool, where you can view, add, and edit data contained in invoices, expenses, time tracking, estimates, and client records.

Customer Support

FreshBooks has a great customer support system to ensure that all clients are able to quickly get any issues solved. Phone calls are answered immediately. Email messages are replied to within a few hours (not days). The online documentation is expansive, so if you don’t want to bother with speaking to a representative, you can always tackle the issues yourself with large amount of self-help resources available.

Phone: Monday to Friday, 8AM to 8PM.

Email: Response time is usually within a few hours.

In-Platform Help Section: Search function for FAQs, or leave a message for the support team to get back to you on.

Documentation: Huge pool of written resources that will answer the majority of your common queries. Lots of how-to guides, articles explaining new features, and other documentation that will help both new and advanced users.

Video Tutorials: Webinars are available to help new users familiarise themselves with FreshBooks.

FreshBooks: The best choice for freelancers, sole proprietors, and (very) small businesses

New users will be wowed by FreshBooks’ outstanding design, sheer simplicity of use, and host of useful accounting functions.

FreshBooks is perfectly designed for those running a solo company, or a very small business with less than 5-7 employees. This platform allows you to capably manage your finances, helps you track projects, and automates time-consuming tasks like sending repeat invoices. It does all of this with a really attractive and intuitive user interface.

Although FreshBooks is an outstanding accounting platform solo ventures or small companies, it doesn’t feature the sort of in-depth accounting functions that larger businesses will need. For companies that need web-based accounting for small businesses, Xero or QuickBooks (our choice) are better options.

Ready to get insured?

If you’re running a business, don’t forget to protect your company. Provide offers the best online business insurance. Get a quote within 60 seconds, and save up to 25% on your premiums. Have a look at our most common policies: