Xero Review 2020: Online Accounting for Small Business

| Pros | Cons |

| Rich accounting features | User interface could be more intuitive |

| UI fairly intuitive | Customer support takes longer than needed to respond, needs improvement |

| Can generate 80+ different accounting reports | Mobile app functionality is poor |

| Inventory tracking | |

| Fixed asset management | |

| Customisable invoices | |

| Extensive third-party integrations to extend functionality even more |

Xero is overall a great software package for online business accounting. Xero serves more than 1 million businesses globally, and its easy-to-use interface and advanced features make it loved by many small-medium enterprises (SMEs). Xero boasts great functionality: extensive reports, customisable invoices, inventory tracking, and 800+ integrations. It also has unique features like allowing you to manage fixed assets, which other competitors don’t.

Xero is really ideal for small-medium businesses that need strong accounting features, put together in a well-designed package that really helps save time on accounting.

Xero Add-Ons

Payments

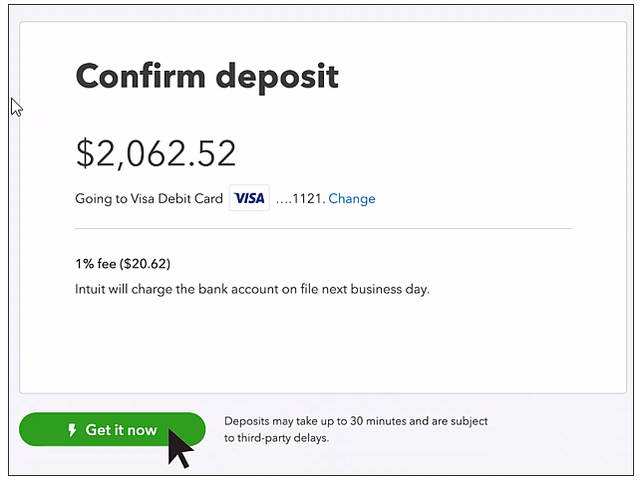

You can accept online payments with Xero Payments, which are powered by Stripe. Transaction fees are 3.4% + SGD 0.50 for online payments.

Payroll

Xero comes with a helpful Payroll add-on. You can schedule automatic wage payments (weekly, bi-monthly, monthly, etc.). You can pay employees specific amounts for the type and amount of work they do (e.g. software engineers who did both coding and graphic design for a project). You can also easily reimburse employees for work expenses.

New Additions

In the latest global update in September 2019, Xero added several new features on top of its already impressive function-rich base.

HubDoc Permissions

Xero acquired HubDoc in 2018, which allows users automate manual tasks like data entry and document collection. HubDoc scans documents like your receipts and bills, automatically extracts information, and uploads it as transaction data.

Previously, if you granted employees permission to HubDoc, they were able to see all uploaded documents without the possibility of individual restrictions. Xero’s latest update allows you to set specific permissions for each user: upload only, standard, or accountant/bookkeeper.

Stripe Live Feed and Auto Pay

You’re now able to view your Stripe transactions in real-time via Xero. This allows for easy reconciliation and simple importing of transactions. You can do this even if you don’t use Stripe as a payment service within Xero’s platform.

You can also receive automatic repeat payments from customers directly with Xero. You can set up repeat invoices for customers, and your clients can save their credit card details to make automatic payments to you.

Zendesk API

If you use Zendesk to manage your support functions, you now have a really useful integration. Your support team can now input the time they’ve spent on their support tickets directly into Xero’s time tracker. Logged hours can be instantly invoiced and reported, so there won’t be double entries caused by your support team manually entering hours in their own schedules.

Xero’ Features

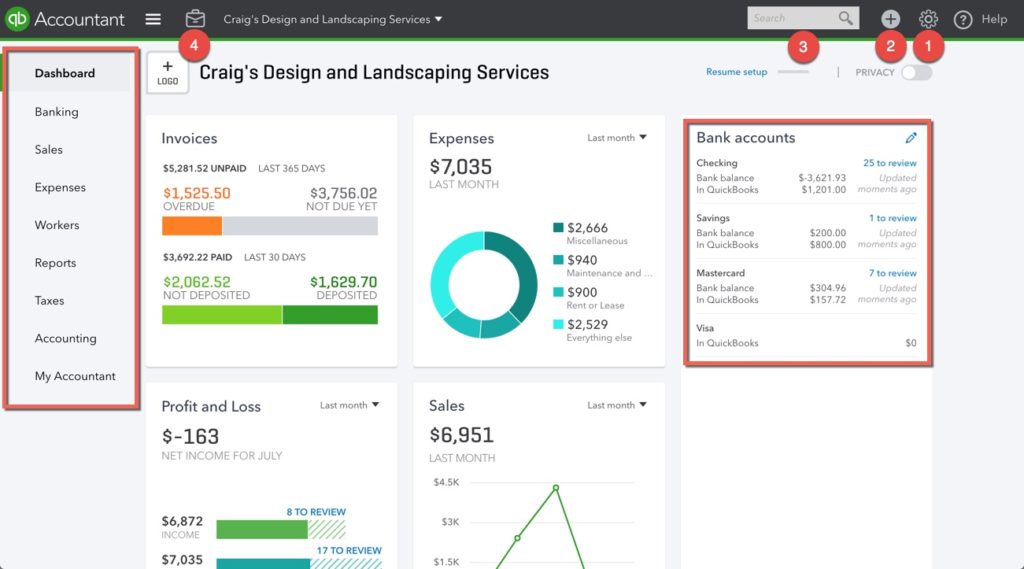

Dashboard

Xero’ dashboard is clean and well-designed. It gives you a quick overview of your total cash balance, invoices, owed bills, and bank balances (if you’ve connected your bank accounts). You can move these accounts around, which is nice if you want to prioritise certain information. Xero’s dashboard gets the job done by giving you the most important information about your business every time you log on.

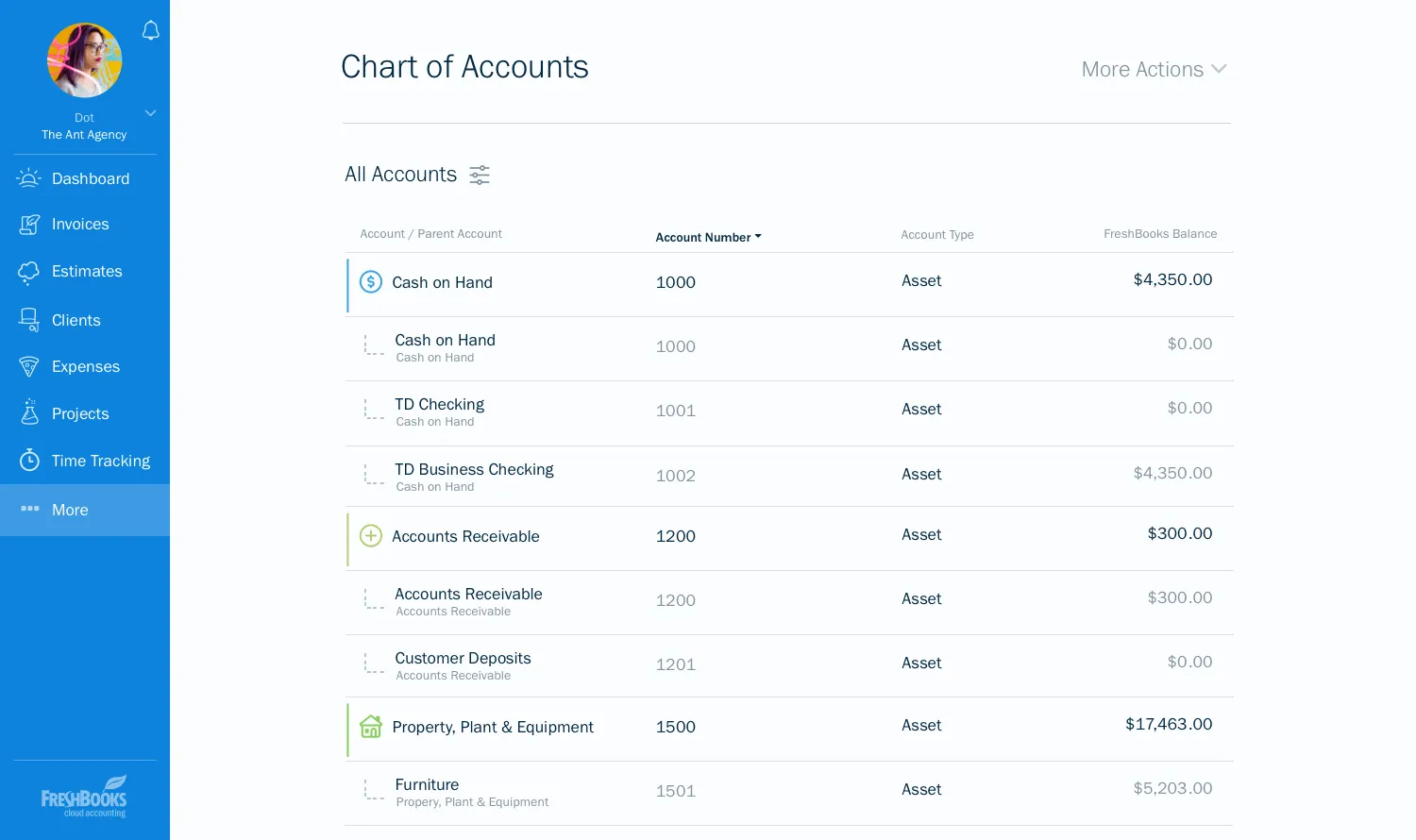

Chart of Accounts

Xero will create a chart of accounts template for you based on your industry. You can also import another chart of accounts into Xero. The layout is clean and it’s easy to filter through the list to find specific transactions.

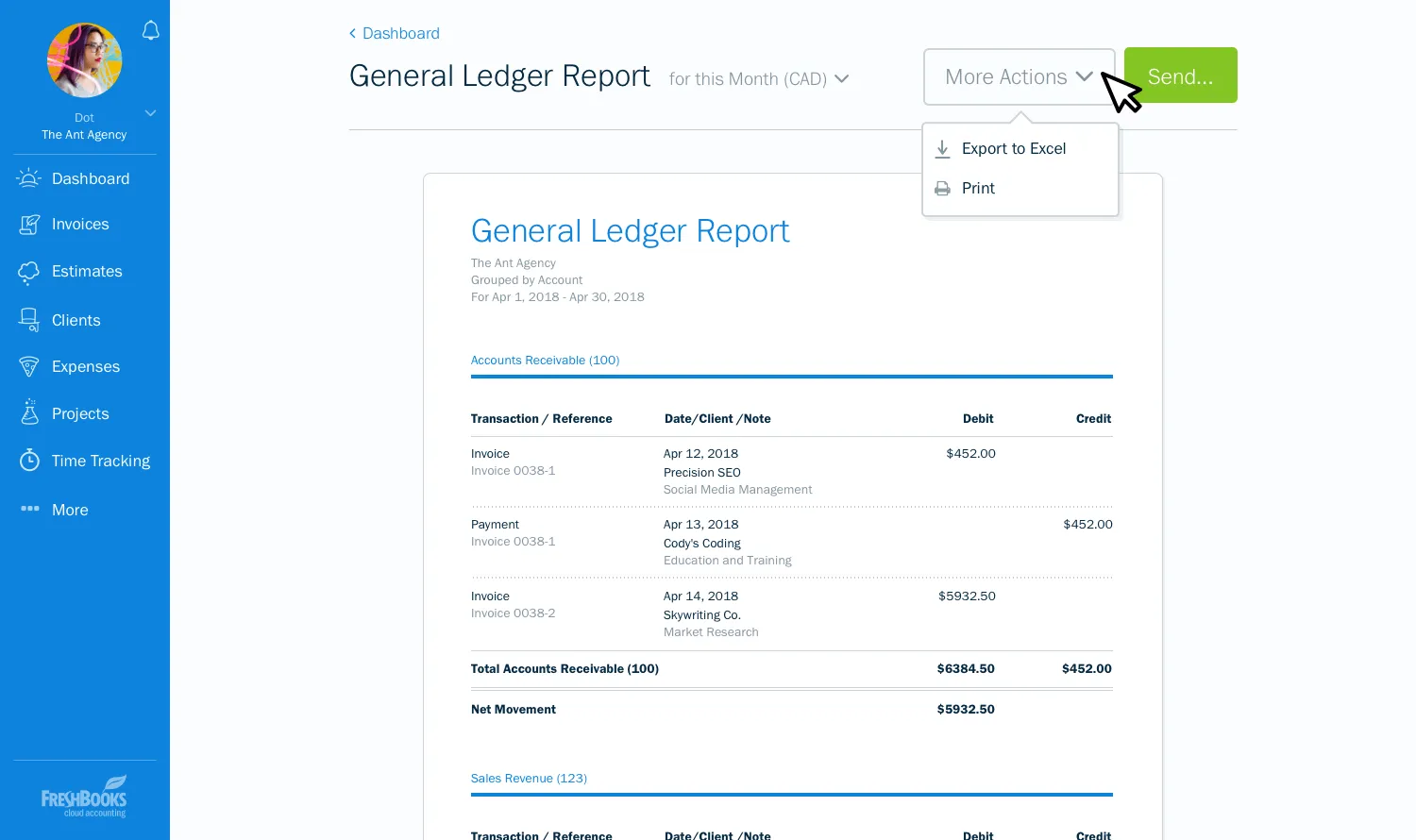

General Ledger

Xero’s general ledger is well laid out. Transactions are sorted by account (e.g. advertising, utilities, etc.), so it’s easy to see the overall status of major parts of your business. The general ledger shows you debits, credits, net movement, and the YTD balance. All this is helpful in quickly understanding how each account is performing, and if major inflows/outflows are occurring you can easily spot them.

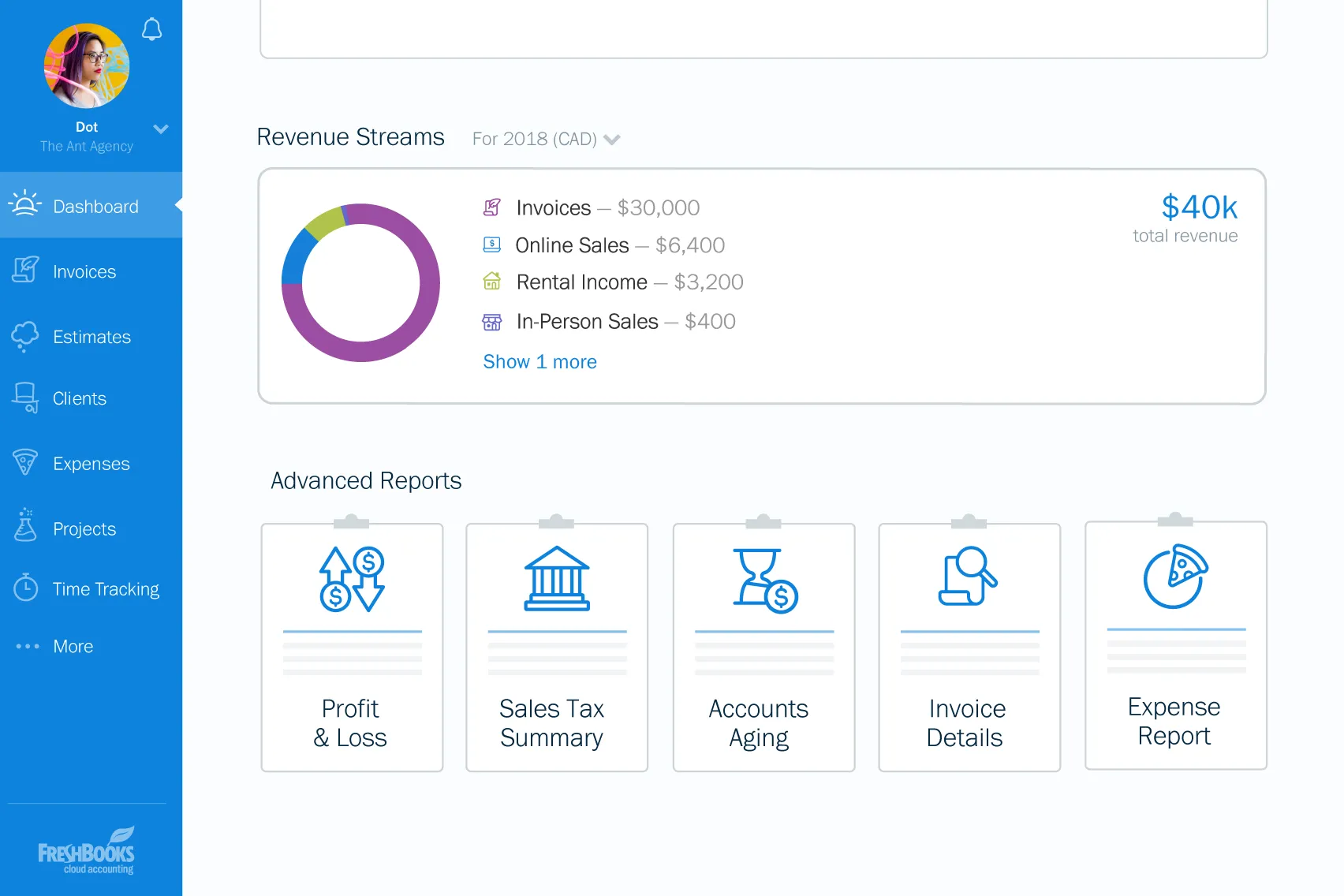

Business Performance

Xero’s Business Performance dashboard gives you a comprehensive look at a wide variety of performance metrics. You can see total revenue, expenses, your top 5 customers, cash balance, payables, overdue bills, and much more. You can view many common financial metrics that gauge liquidity, efficiency, leverage, and profitability. These include Account Receivable (AR) days, Account Payable (AP) days, Inventory Turnover, Current Ratio, Debt to Equity Ratio, etc. All these metrics are presented in graph form over time, so you can easily track how your business is improving (or declining). Having a business intelligence tool like this in your accounting software is certainly helpful.

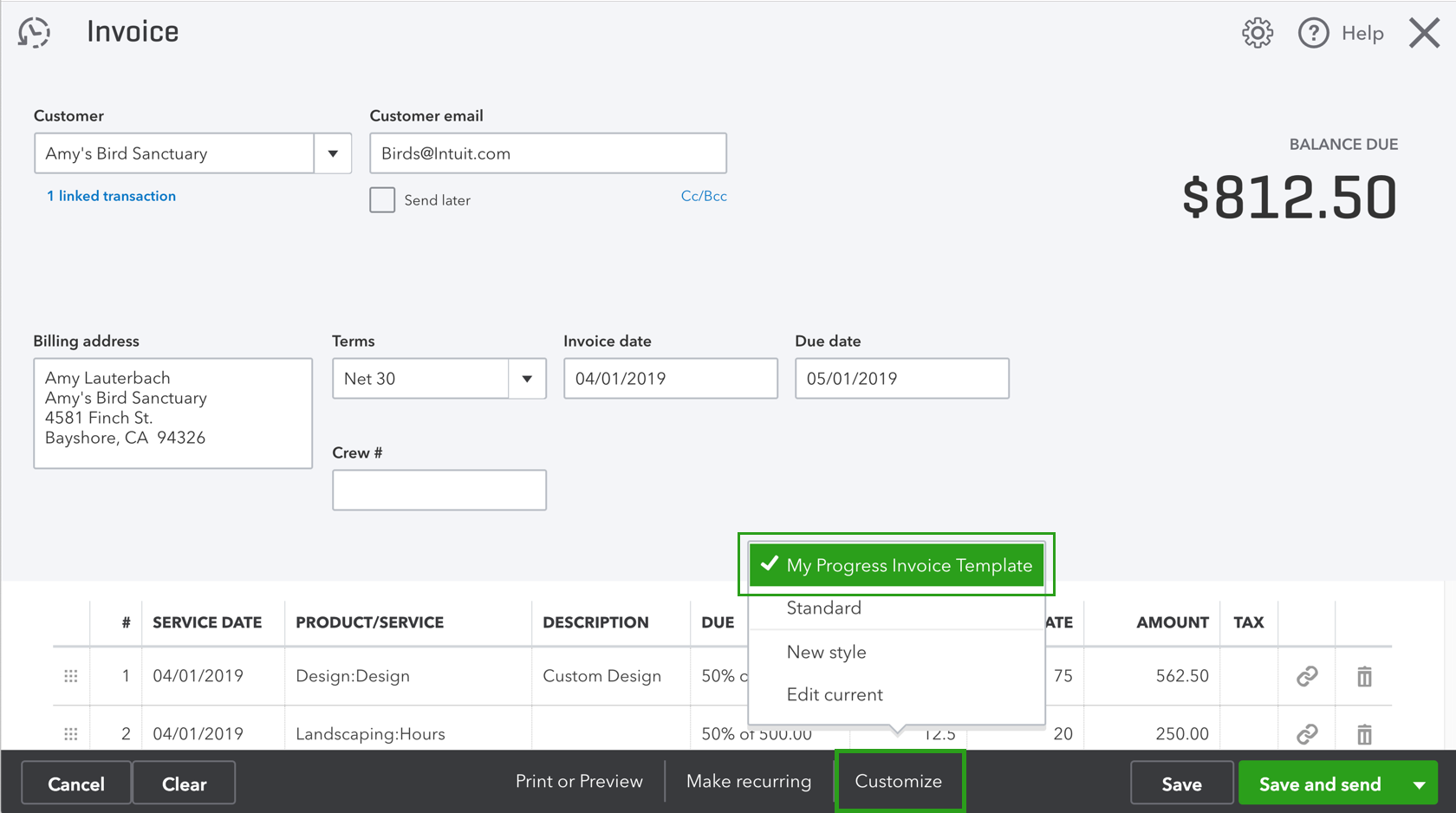

Invoices

Xero only has 1 default invoice template, which is lacking compared to competitors that offer many different options. You can create your own custom templates though. Invoices are highly customizable: you can change the logo, font, colour, background, header, footer, and many other elements. Xero’s feature-rich strengths come into play here – you can set up recurring invoices to save time on billing, schedule automatic invoice reminders, send invoices in bulk, and set default payment settings for customers. You’re able to see when your customers have viewed your invoices. There’s even a live preview for invoices so you can see exactly what you’re sending.

Xero has a unique service called “Xero to Xero”, where you can easily send invoices to other companies that also use Xero. Do note that Xero to Xero invoices can’t be sent if your invoice has tax adjustments or credit notes. Xero only supports English for invoicing.

Contact Management

Xero’s client management system is one of the most comprehensive in the game. On top of basic information like contact details, you can add discounts, and sales tax rates. You can even tag attachments to each contact (like legal documents, images, etc.) You can group different customers into “smart lists”. This allows you to target each group with different marketing offers. You can also send invoices to entire groups with a single click.

Payroll

Xero’s payroll add-onXero comes with payroll functions included, which is a nice touch. Most competitors charge extra for this function. You can schedule automatic wage payments (weekly, bi-monthly, monthly, etc.). You can pay employees specific amounts for the type and amount of work they do (e.g. software engineers who did both coding and graphic design for a project). You can also easily reimburse employees for work expenses.

You can also subscribe to Xero Payroll alone if you don’t want to use the full Xero package.

Client Portal

Xero offers your clients a clean-looking portal where they can view invoices. Your clients can pay you directly on the portal, and can also send you comments if they have queries or issues with your invoice.

Estimates

You can easily send professional estimates to your clients, which can then be converted into quotes when your client accepts.

Purchase Orders

You can create purchase orders. If your supplier ships your goods to you piecemeal, you can record how much inventory you’ve already received. You can convert purchase orders into bills.

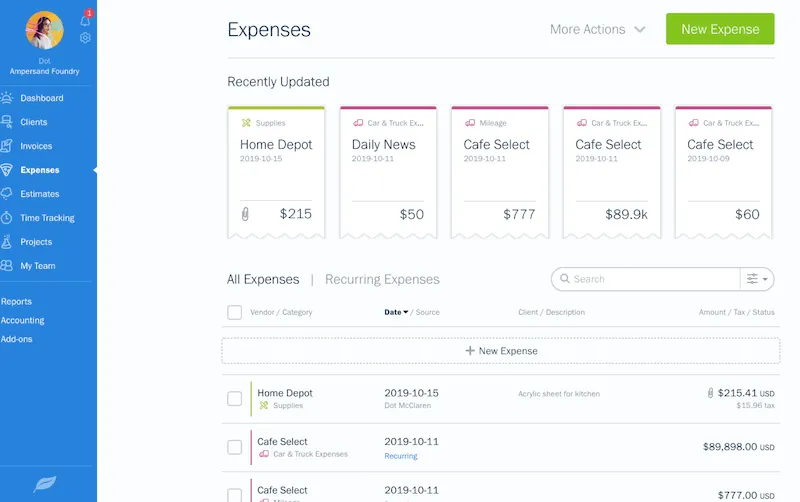

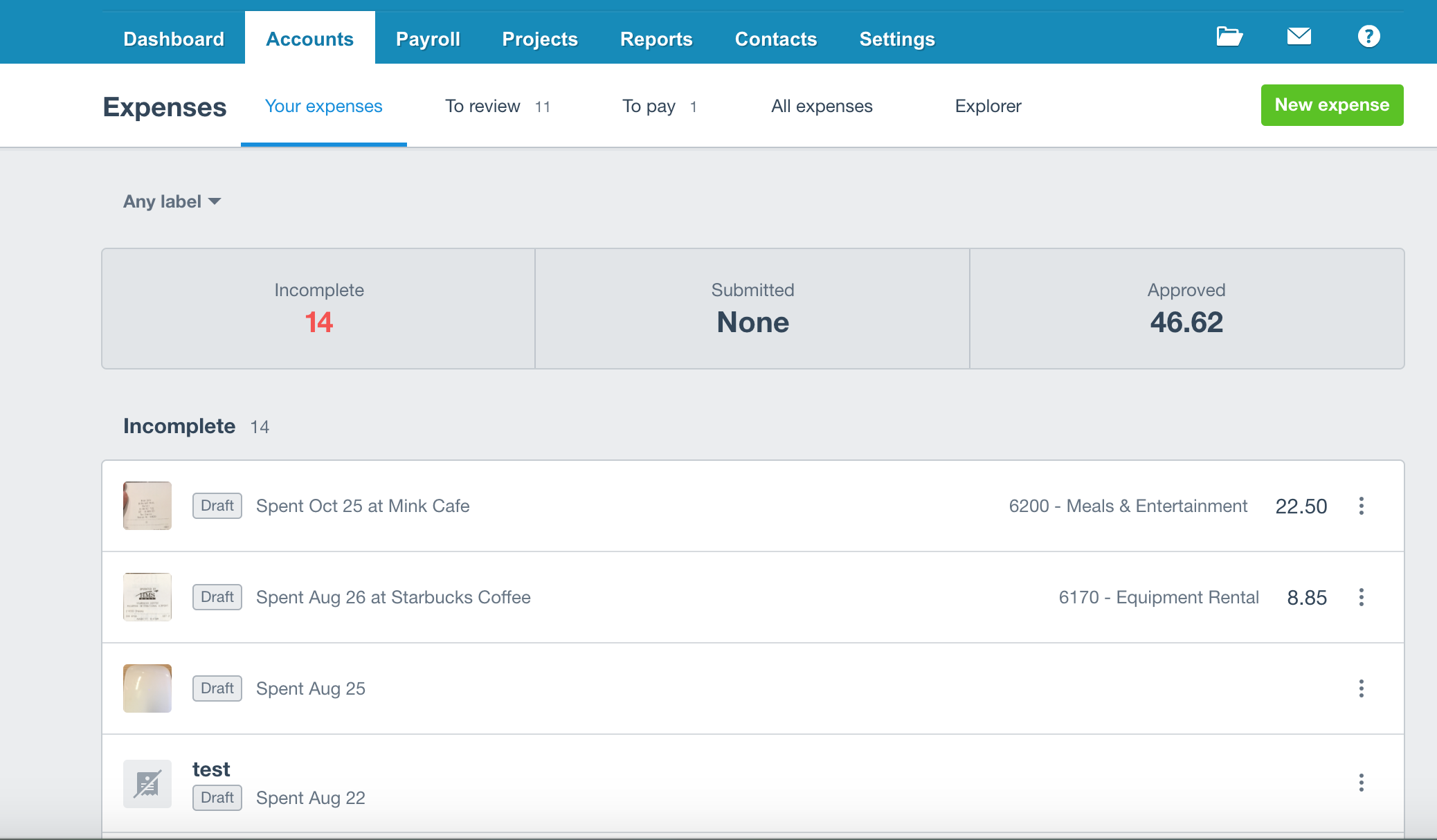

Expenses

You can connect Xero to your bank accounts to enable “live” importing of transactions. When you connect your bank account to Xero, the software will automatically import your last 90 days of transactions.

Categorising expenses is easy with over 80 default categories to choose from. You can also create your own custom expense categories. Xero has a useful receipt capture function that allows you up to upload receipt images, with Xero automatically extracting key information like transaction amount and date from the receipt. You can then tag receipts to specific expense payments.

You can also create bank rules to automatically categorise your transactions. Xero uses machine learning tools to learn your categorisation patterns – the more use Xero, the better it gets at sorting your transactions for you. This is a big time saver.

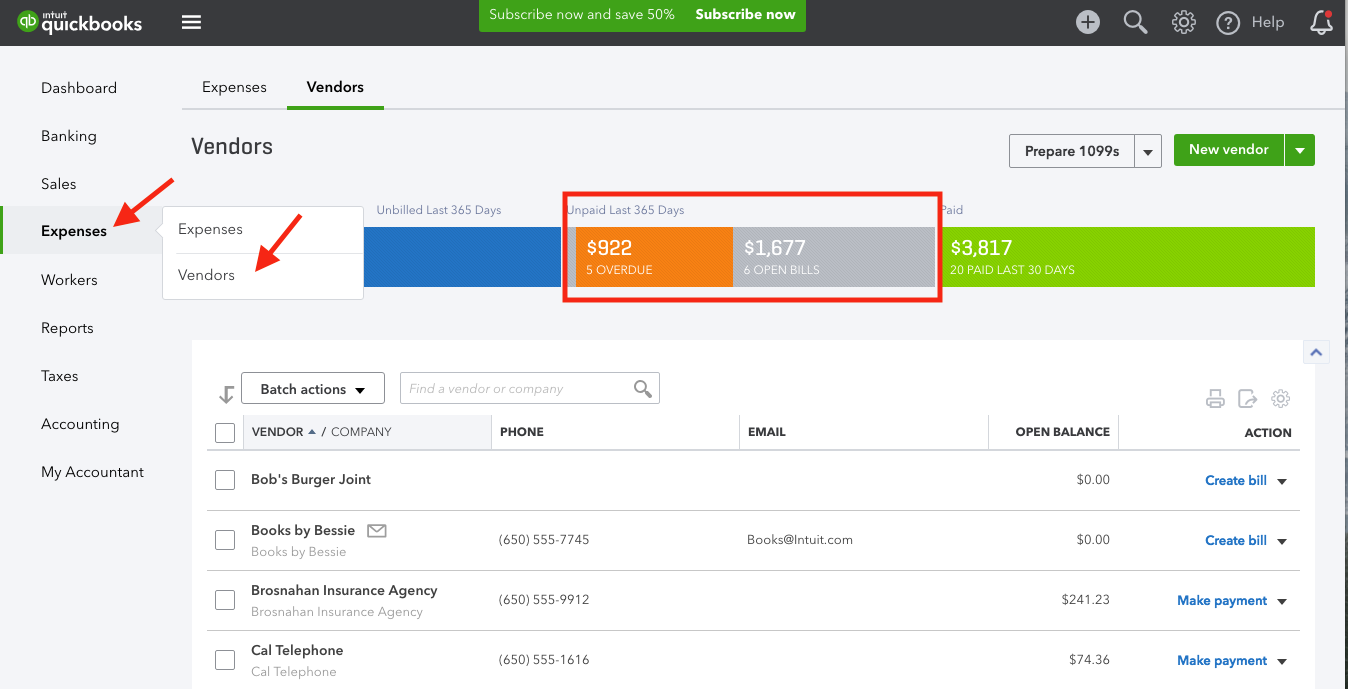

Accounts Payable

Xero has an informative “Purchases Overview” dashboard that shows you all you need to know about your bills. You can view upcoming bills. There’s a well-designed dashboard that shows you all your vendors, your total purchase value, and your overdue, outstanding, and paid bills.

Inventory

Xero helps you track your inventory and displays basic information about your stocks. You can add inventory items with basic information like unit prices, descriptions, images, and notes. If you use Xero’s inventory tracker, you’ll be able to view helpful information like total stock value, average cost, number of items that you’ve committed in quotes, and number of items that you’ve ordered.

However, Xero doesn’t allow you to track negative inventory, so if you record the sale of goods before you’ve recorded their purchase you won’t be able to use this function. You can’t track components that make up final goods (annoying for manufacturers), and you also can’t track goods if you use periodic inventory methods (e.g. you only update at months’ end). Unfortunately, unlike with QuickBooks, you can’t set automatic re-ordering alerts when stocks are running low. If you need these functionalities, you’ll have to explore Xero’s app marketplace for third-party integrations.

Fixed Asset Management

Xero comes with this unique feature, which allows you to manage fixed assets. You can create different depreciation schedules: straight-line, declining balance, double declining, etc. You can also roll back depreciation. You can set up default disposal accounts when you need to get rid of your assets.

Packing Slips

Xero doesn’t come with a packing slip function built in. You’ll have to download the Packing Slip template from Xero’s website. It would be easier if the platform came with this function as a default.

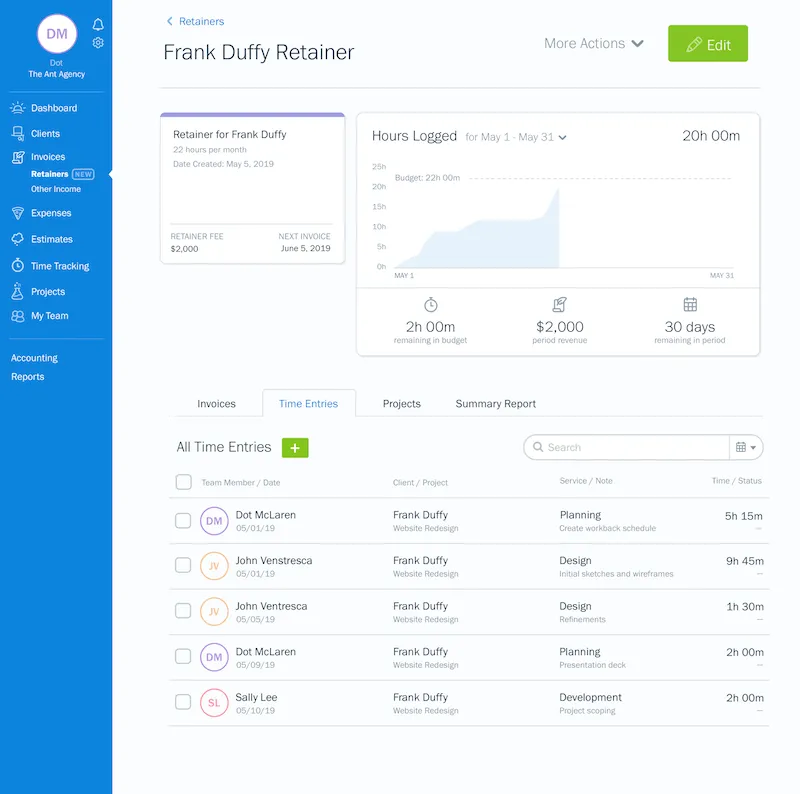

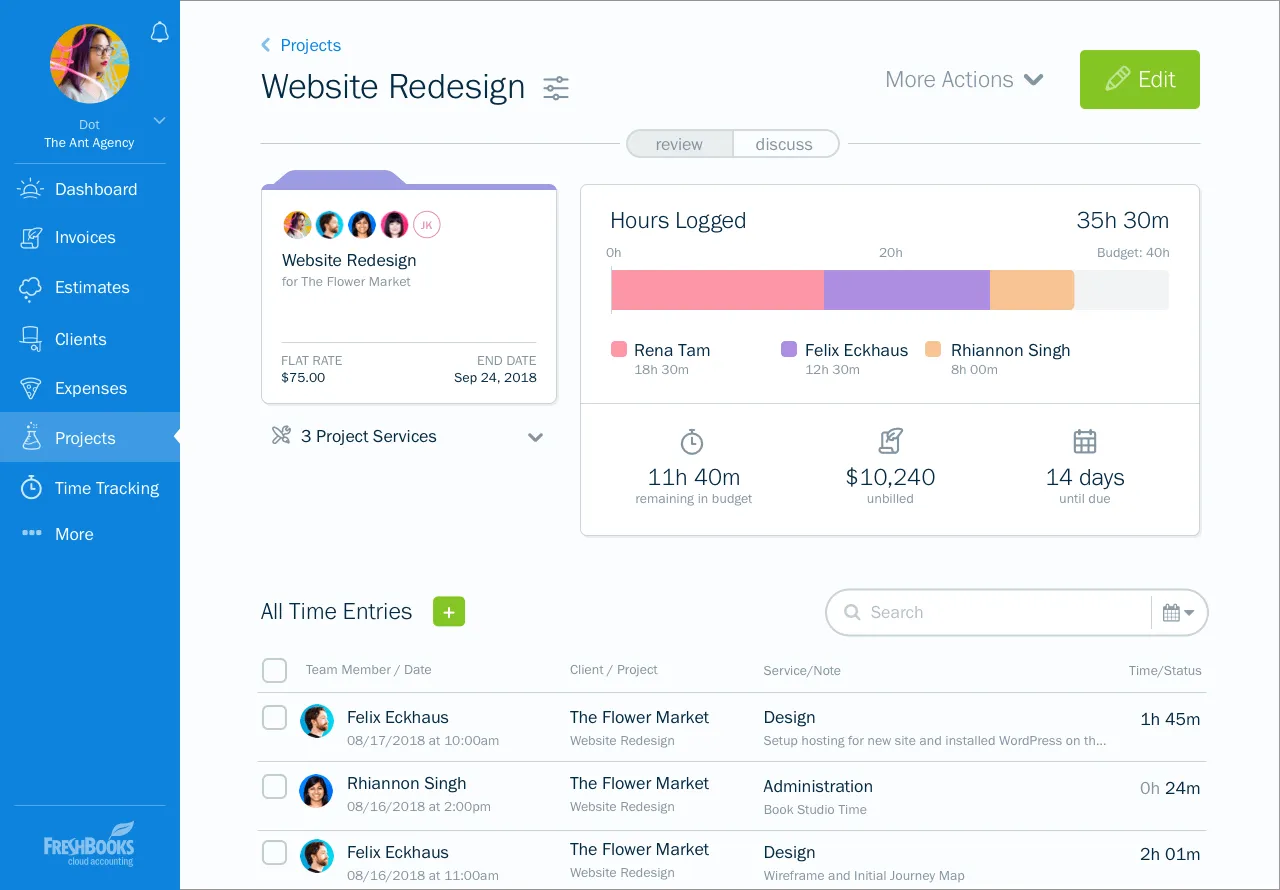

Project Tracking

Xero has all the industry-standard project features: managing team members, tracking individual hours allocated, and assigning invoices and other bills to projects. A nice added feature Xero has is project profitability tracking. This helps you prioritise the highest earning projects, and also enables you to quickly address margin issues that may occur with particular projects.

In terms of control over project costing, Xero allows you to set hourly cost rates for each staff member you assign to projects. You can also load your employee’s work hours into Xero Payroll to quickly calculate the wages you owe them which is a good time-saver.

Time Tracking

Xero automatically reports time and costs into your invoices and accounting records. You can convert timesheets into invoices for easy billing. Like other time-trackers, there are automatic functions (start/stop button) and manual timesheet entries.

Budgets

You can create up budgets for various time horizons: 3 months all the way up to 2 years. You can compare these budgets with actual business performance to see how much you’ve beaten (or missed) targets by.

Outsourced Bookkeeping: Xero doesn’t have a “live” bookkeeping function like QuickBooks, but it does have an advisor directory where you can find a local accountant near you. You can then engage this accountant, and Xero allows you to give your accountant read-only access to your account so they can effectively manage your books.

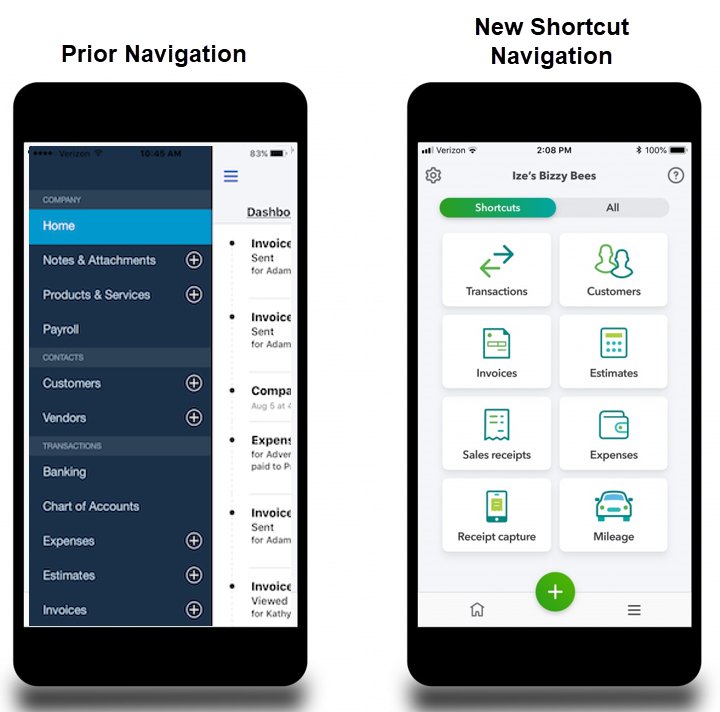

Mobile Apps

Users often comment that Xero’s mobile app functionality is lacking compared to its desktop version.

Xero Customer Support

Xero’s after-sales support is where it really falls short, which is a pity given how robust the actual software package is. Customers have left numerous reviews citing poor support – long wait times for a response being the chief culprit. If Xero could invest more into supporting their customers, then the platform could really push past all its competitors.

Phone: Xero does not offer phone support. If you need to speak to someone urgently, you’re out of luck.

Email: Users have often reported having to wait for a day to get a response from Xero’s support team. Xero has a helpful function that allows you to give Xero support staff read-only access to your account, which helps them directly diagnose and solve whatever issues you might be facing.

Message: Xero has a live chat function, but it’s not located on the accounting platform – you have to go back to xero.com to access it. Users report the support representatives usually answered their queries well enough, but it’s puzzling why Xero doesn’t just include their live chat function within their accounting platform.

Documentation: Like its main competitors, Xero has an extensive base of online documentation. There are in-depth guides to all of Xero’s functions. There’s a community forum where users post questions and other users and Xero representatives will answer them, so you’ll probably be able to find an answer to whatever queries you have here.

There’s an FAQ, blog, and Q&A forum that helps users understand all of Xero’ functions, from the simple to the complex. There’s also a live “AI” chat that can answer basic questions like “how much sales did I generate last year” or “which payments are overdue”.

Videos: Xero has hundreds of video tutorials (called XeroTV) to help you navigate the platform.

Podcasts: Xero also has podcasts that feature business advice, like how to retain staff or how to build software businesses. I’m not sure if anyone really listens to these clips, but if you really want business-related audio playing while you’re on your morning drive, I suppose you could play this on your speakers.

Ultimate Verdict

Xero is a great online accounting software for small-medium businesses, especially for beginners just starting to use an accounting platform. Its features and UI are designed to let newcomers hit the ground running, so you won’t have to spend much time at all learning how to use the platform’s key functions. It’s a great choice for businesses that don’t need complex accounting features, but still want more functionality than more basic alternatives, like FreshBooks. Xero’s highest-tier plan also supports unlimited users, which is great for businesses that have lots of staff and are growing rapidly.

Xero’s customer support could certainly do with a good dose of improvement, and is really a pity given the polished quality of its product. This, and its lacklustre mobile offering mean that Xero still has a ways to go before it can claim to be the undisputed no.1 provider of online business accounting services.

In the grand scheme though, these drawbacks are not huge, and Xero’s many strengths certainly outweigh its few weaknesses. For any small-medium business that demands advanced accounting capabilities, strong reporting, a good user experience, and lots of users, Xero stands as a fantastic choice.

Ready to protect your business?

If you’re running a business, don’t forget to protect your company. Provide offers the best online business insurance. Get a quote within 60 seconds, and save up to 25% on your premiums. Have a look at our most common policies: